Johnson Financial Group, Inc.

Life, Health, Medicare, Precious Metals

And Retirement

Long-Term Care Insurance

Consult An Agent In Abingdon, MD About Long-Term Care Insurance

Long Term Care Insurance In Abingdon, MD

The decision whether to purchase a long-term-care policy is one of the most important decisions that you will make. Long-term-care insurance typically covers the cost of home health care, assisted living, and nursing home care. Having the proper policy in place can protect you and your heirs from the financial effects of a long term chronic illness.

There are many reasons – illness, injury, or aging, why an individual may find themselves needing help with the Activities of Daily Living (ADLs).

These activities are:

Eating

Bathing

Dressing

Toileting

Continence

Transferring out of a chair or bed

In general, if a person can’t do two or more of these activities, or has cognitive impairment, they are said to need long-term-care. Without a long-term care policy in place, the cost of caring for yourself or a loved one who has a chronic illness can be very expensive, but the cost of a long term care policy can also be expensive as well, and that cost will depend on your age, health status, and the benefits included in the policy when it is purchased.

What Are The Odds?

Consider these facts:

About 70% of people over age 65 will need some kind of long term care at some point, and more than 40% will need care in a nursing home

20% of individuals in nursing homes will stay more than 5 years

The senior population of America is increasing, and the number of people aged 65 or older will double in the next 20 years, and there will be 110% more people age 80 or older

The average cost of care in a private nursing home is nearly $7,000 per month, and has increased for six years in a row, outpacing inflationUPDATED | Content Section w/ Pictur...

Medicare Will Not Cover The Cost Of Long Term Care

There are a lot of misconceptions when it comes to paying for the cost of care. One of the biggest misconceptions is that Medicare or health insurance will pay for some or most of the cost of care that takes place in a nursing home, assisted living facility, or in-home. This is not the case.

Health insurance and Medicare cover little or none of the cost of custodial care (assistance with the 6 activities of daily living). Medicare and most private health insurance policies only pay for the cost of skilled nursing, (medical services, nursing and rehabilitative services, help taking medications, blood pressure testing, etc.), and other similar services, not custodial care.

If you’re 65 or over, don’t count on Medicare or private health insurance to pay for long term care needs. For those with very limited financial resources, you might qualify for Medicaid, a government program that pays the medical and long-term care expenses of poor people, and if you have some resources, you may be required to spend-down those assets first in order to qualify for Medicaid. This could potentially exhaust a family’s financial resources, and the potential for this kind of situation is an excellent reason to address long term care choices before the need arises.

What Are The Options To Cover LTC Costs?

When it comes to covering the cost of long-term-care, there are 3 main options:

1. Self-Insure

2. Buy A Policy

3. Reposition Some Already Accumulated Assets

Let’s take a closer look at each of these options.

Option 1 - Self - Insuring

When we think of the concept of self insuring for long term car, this typically means either

1. Saving money in an interest earning account that will be used for long term care costs if needed or

2. Doing nothing and betting against the odds of needing care

Let’s look at option B, doing nothing first. As we looked at above, the odds are pretty strong that care will one day be needed, so doing nothing could mean one day possibly having to spend down all of your assets to qualify for Medicaid, and/or having to depend on a governmental system that may be over-burdened and may not have the funds to take care of all of the people needing care. This is not a good option for most people, as it could mean losing everything you have, and still not receiving an acceptable quality of care if needed.

Option A – Save money to pay for future long term care costs – as we have seen from the current costs of long-term-care, the amount that a person will need is substantial, and future costs, adjusted for inflation, will probably be much more than the average person could save for the quality of care that they would want to have. We also have to consider how long the care would be needed for, and this could possibly be 2, 3, or more years, which would probably exhaust the assets. As we can see, saving money to pay for care one day is also probably not a good option for most people.

Option 2 - Buy A Long Term Care Policy

If you are considering purchasing a long-term-care policy, there are a lot of things to consider. It makes sense to work with an unbiased, independent agent who can help you compare the costs and benefits of policies from several top-rated insurance companies.

Traditional long-term-care policies are one type of LTC policy, but the price can be expensive, and will depend on your age and health status when you buy the policy, as well as how much coverage you want. There also can be various riders, and other features of the policy that will affect the price, so it pays to work with an expert when choosing your policy.

A Deferred Fixed or Indexed Annuity with Long-Term-Care Benefits is a type of hybrid or dual purpose policy, and can be an excellent way to tackle 2 problems at once: saving for retirement and paying for long-term-care if needed.

Life Insurance with Long-Term-Care Benefits is another type of hybrid policy where a portion of the policy’s death benefit is paid out to cover long term care expensed if needed.

Both of these types of Hybrid-LTC policies, Annuities and Life Insurance, just became even more attractive on January 1, 2010 because of provisions in the Pension Protection Act of 2006. Before 2010, a person who bought this type of hybrid policy was taxed on any payouts. Now, payouts are distributed tax-free.

Option 3 - Reposition Some Already Accumulated Assets

As we mentioned above, because of the new federal law, the Pension Provision Act, starting January 1, 2010 funds that are transferred directly from an annuity, or from the cash-value portion of a life insurance policy to pay for long-term-care insurance are also no longer taxable as income. This is an excellent way to fund a policy – someone who has an annuity or life insurance with cash value accumulation can take those funds to pay for long-term-care policy premiums.

In addition, there are other hybrid products that can pay out at least double the initial deposit upon the death of the policy holder, income tax free, and it also provides up to 5 times the money you deposited for long term care needs, if needed.

Example: A man, age 55 deposits $52,200 into account. At death his family receives $100,000 income tax free. If he needs long term care he has $300,000 in benefits available.

LTC Insurance - No Longer Use-It-Or-Lose-It

As we have already stated, there are some long term care products available today that can serve 2 purposes: long term care if you need it, and life insurance if you never need long term care. Some policies will even refund you all of your money at any time during the contract period!

LTC With Return Of Premium

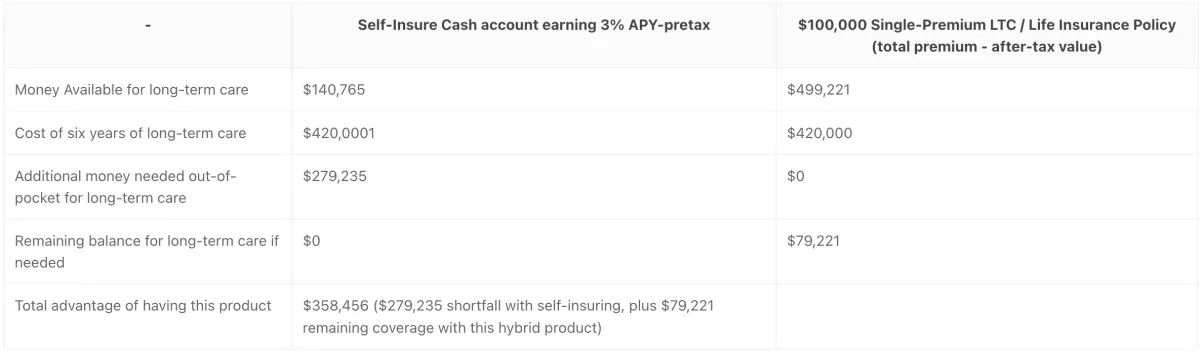

Long-term care cost reimbursement if you need it, or your money back if you don’t. Example: Ann-a 65-year-old non-smoker looks at her options. What if she needs six years of long-term care beginning at age 80?

In Case Of Death:

What if Ann never needed long-term care while owning this hybrid LTC/Life insurance product?

Her beneficiaries would receive $166,407 in death benefit.

Money-Back Guarantee:

What if Ann changes her mind and no longer wants this product?

Ann can receive her money back. It’s a win/win situation for everyone involved.

1 This total long-term care cost assumes a 0% annual inflation factor was applied to a current long-term care cost of $70,000 per year. At age 80, the need for long-term care is assumed to begin and continue for six years. The same inflation factor of 0% is applied to the projected cost during the six-year period.

Why Purchase Your LTC Policy Through JFG?

At Johnson Financial Group Inc., we are long-term-care insurance experts. We work with numerous A-rated carriers, stay knowledgeable about all of the available products, and are committed to providing our clients the information that they need to make the best decision about something as important as long-term-care insurance. We always evaluate the situation and make product recommendations that solve the problem in the most cost effective and efficient manner possible, always putting the client’s needs and best interests first.

Let us help you to come up with a long-term-care plan of action, or let us provide a quote for long term care coverage. If you would like more information on LTC coverage, please give us a call at 443-807-7311, or complete the information request form below, and we will contact you.

Life, Health, Medicare, Precious

Metals And Retirement

© Johnson Financial Group Inc. All Rights Reserved.